Latest Updates

Read our latest blog posts and news releases.

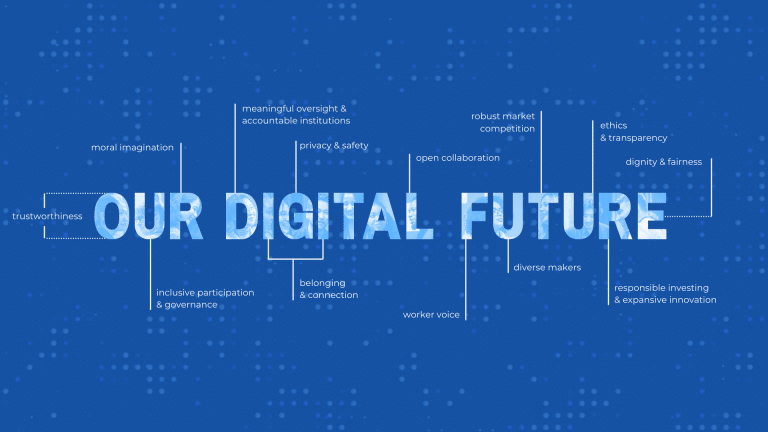

Perspectives

We publish our points of view for the more durable areas of our work to enable those who work with us—and those who might disagree with us—to have clarity on what we are trying to achieve.

Although we express our own viewpoints, we know that the hard work of generating impact, developing new ideas, advocating for policy, and other activities will largely be done by those we fund and those with whom we partner.