By Roy Steiner

Omidyar Network’s Intellectual Capital team serves as our in-house strategy, research, and impact group, working for our initiatives and investees, and helping us to cultivate our firm’s commitment to learning. As part of that work, we’ve started tracking trends to widen our view of the world today and the world to come. We can’t predict the future, but we can build a muscle for foresight, to become better informed investors and partners.

Today I’m pleased to share an exchange with my colleague, Eshanthi Ranasinghe, who worked with The Future Hunters to scan the horizon and develop a report on 10 trends to watch over the coming year. I talk with her about why it’s important to develop this foresight muscle and implications she sees for the field.

Roy Steiner: Why did you seek out these trends, and what do you hope it’ll do for readers?

Eshanthi Ranasinghe: We’re living in an increasingly dynamic world. There are things coming at us — unexpected events and trends, unlike anything we’ve seen before. They’re impacting societies, institutions, things we considered “permanent truths”. As investors, and as people, we need to keep our eyes open.

The world has always been dynamic, what do you think is different now?

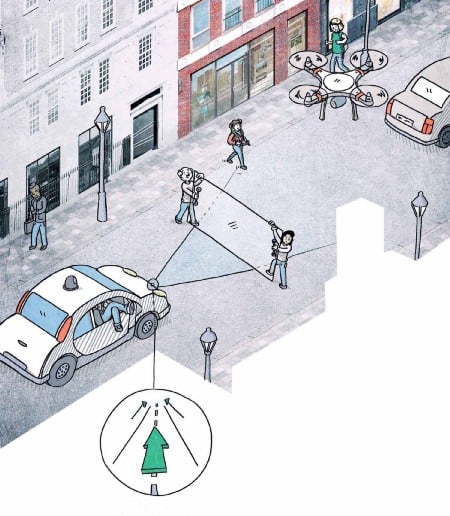

There’s a new feature to the world: ubiquitous technology. Once upon a time, the world changed, but at a more manageable — or at least trackable — pace. Think of a disease. You can track the way diseases spread within a town or village, from village to village. But what happens when you introduce ships? Railroads? Roads and cars? Planes? You get pandemics that move faster than ever before. Now forget disease and villages, and replace them with computers and invisible “wires” connecting them, information broken down into bytes that can move along those wires. Connect those wires to people. Add smartphones to the same connections and people. Add the Internet of Things. Ambient computing. You get hyperconnectivity. Blurring lines between people and computers. Now put a disease on those wires, put addiction. Put innovation and ideas. Put good actors, bad actors, ambivalent actors. What happens? Constant, swift, unceasing change.

That sounds exciting and daunting. How can we learn about and internalize it all?

We probably can’t! But as cheesy as it sounds, we’ve got a pretty powerful machine in each of us that can help — our brains. As investors, we process trends and signals all the time. Scientists are still trying to understand the capacity of the human mind. But, human minds are fallible. We are subject to all kinds of cognitive biases, information asymmetries, blinders, and echo chambers. What we’re trying to do with trends and foresight is to take advantage of what the human mind is good at: absorbing information, intuitively finding patterns, and making decisions, and attack what it’s bad at: developing new mental constructs, seeking contradictory viewpoints, remembering that everything is dynamic and nothing is constant.

How do we do this, practically speaking? We’re already busy managing the unknown in our work and in our lives. How do we keep in mind the unknown beyond that?

That’s where we’re hoping reports like this can help. We’re looking for signals, narratives, information that fall outside of the usual purview. The goal is to provoke. We want to build not just a knowledge base, but a way of thinking — viewing trends and signals as an evolving chess board, where we stop, evaluate, imagine where things could go, and make a move. To develop foresight, you need facts and imagination — and to embrace discomfort. You’ll see the blend of these in the report.

You need to be uncomfortable to learn. How do you suggest readers use trends?

A few pieces of advice, inspired by what some of my colleagues have shared with me so far —

- Seek discomfort — That’s where the most interesting insights occur. The trends really range, from the rise of neotribalism, to 3D and 4D printing, to “cybrids”, or how Gen Z is developing differently from any generation before them. Despite this range, Ashley Beckner from our US Education investments team, observed, “every single trend in this document has implications for our work focused on early childhood development. From smart toys to the affectional economy and perhaps most importantly the rising generation of cybrids — we have to stay ahead of these trends as we think about the future for children and families.”The US Education team is in the middle of developing their own trends report, focused on early childhood in the US. Ashley shared with me that this document “sparked new thinking that will influence that [US early childhood education trends] report and our work more broadly.”

- Examine intersections — as Alex Lazarow, a member of our Financial Inclusion investments team, observed, “Each of these macro trends has the potential to radically change the world. But what has the most potent potential is the intersection between. How can moonshots accelerate moving to blue or 3D printing for social good? How will the tandem rise of neotribalism, the affectional economy, and cybrids intersect? There is both the potential for balancing out on a global scale, and rapid acceleration depending on how they mix.”

- Get personal — several folks shared personal reflections that I’d argue can hit on an even deeper insight than a professional read would, because it traverses culture and hits on what it means to be human among these trends. As Peter Drucker said, “culture eats strategy for breakfast”. Yoav Schlesinger of the Tech and Society Solutions Lab, said, “I found the Risk in the White Space section incredibly resonant with our Tech and Society point of view and it pushed the envelope of my individual thinking on how far we might expect technologists to be able to foresee the consequences of their creations. At the same time, as the father of two young girls (ages 4.5 and 2.5), the trends on ‘Cybrids’ was sobering and inspired many conversations with my wife this past week about what it might mean for their neural pathways to be fundamentally altered.” Our colleague on the Intellectual Capital team, Nidhi Hegde, shared, “Affectional Economy was one of the most interesting trends. I have a healthy amount of skepticism about computers having ‘empathy’ but leveraging AI and machine learning to understand different cognitive and emotional states is exciting because it could mean we can finally crack the door open on neurological diseases like Parkinson’s or Alzheimer’s. With an aging world, I think that’s one of the most important problems we can solve and one that’s close to home for me.”

- Be skeptical! — the tone of this report is bold and confident in what are still very much early observations of emerging signals and trends. Question the speculation, but not the facts. And click on the links! Also, keep in mind we selected a handful of trends among hundreds. Stay tuned, more to come…

- Don’t overthink it — this is brain food; don’t read this worrying about how you’re going to plan for robots affecting human emotion or gaining Saudi Arabian citizenship, knowing that the trajectory of all of this could change on a dime. Sarah Morgenstern from our Financial Inclusion team, had a great approach, sharing the report provided, “a refreshing opportunity to step back from my day-to-day and reflect more expansively on the big questions of tomorrow. From the evolving nature of innovation to the shapeshifting challenges of risk mitigation, this… was wonderful food for thought”

Final question: How do you learn from the future?

We open the report with a quote from the “father of cyberpunk” science fiction, William Gibson, who envisioned cyberspace in 1984, “The future is already here, it just isn’t very evenly distributed”. How do you learn from the future? Open your eyes, and pay attention.

Read the 10 Trends to Watch in 2018 & Beyond report here.